30+ debt to income ratio mortgage

Web For mortgages the max debt-to-income ratio allowed in most cases is 50. If you have two credit cards with a combined total credit limit of 5000 and you have a 1000 balance youre using 20 of your available credit 1000 divided by 5000.

Partners Mortgage Roseville Ca

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

. Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes. Web Lenders calculate your debt-to-income ratio by using these steps. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

Compare Mortgage Options Get Quotes. Web For example say that your total monthly obligations add up to 2000 when taking into account all your minimum payments and your new mortgage -- and say your income is 6000. Get Instantly Matched With Your Ideal Mortgage Lender.

Lock Your Rate Today. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Apply Online To Enjoy A Service.

Apply Get Pre-Approved Today. Ad Compare Mortgage Options Calculate Payments. What factors make up a DTI.

Mortgage lenders use debt-to-income ratio or DTI to compare your monthly debt payments to your gross monthly income. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Lock Your Rate Today.

Compare Mortgage Options Get Quotes. Ideally lenders prefer a debt-to-income ratio lower. Get Instantly Matched With Your Ideal Mortgage Lender.

Web 20 hours agoThe current 30-year fixed-rate mortgage refinance rate is averaging 713 according to Bankrate while 15-year fixed-rate refinance mortgages average of 637. Bank Is One Of The Nations Top Lenders. Apply Now With Quicken Loans.

Dont include your current mortgage or rental payment or other monthly expenses that arent debts such as phone and electric. Ad Compare the Best House Loans for February 2023. Ad Compare Mortgage Options Calculate Payments.

Web Heres how the debt-to-income ratio is calculated. Web Your debt-to-income ratio for mortgage applications is one of the most important factors lenders consider. 1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car loans and leases and student loans.

Ad Compare the Best House Loans for February 2023. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Heres a quick example.

Highest Satisfaction for Home Loan Origination. Build Financial Confidence With A Conventional Home Loan. Get Started Now With Quicken Loans.

Even then Redfin put the. Web What is a debt-to-income ratio. Get Started Now With Quicken Loans.

Save Real Money Today. Web For example if your monthly debt equals 2500 and your gross monthly income is 7000 your DTI ratio is about 36 percent. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032.

Web When you apply for credit your lender may calculate your debt-to-income DTI ratio based on verified income and debt amounts and the result may differ from the one shown. Apply Get Pre-Approved Today. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033.

Total monthly debt paymentsGross monthly income x 100 Debt-to-income ratio. In this formula total. Apply Now With Quicken Loans.

Typically a good debt-to-limit ratio is 30 or less. Web 21 hours agoSpending 30 on rent would mean around 1750 on housing and leave over 4000 for other spending -- including savings and investments. Find out what a DTI ratio is and how to calculate it.

Youd divide 2000. 1 2 For example. Multiply that by 100 to get a.

Effects Of Easing Ltv Dti Regulations On The Debt Structure And Credit Risk Of Borrowers

Debt To Income Ratio Crb Kenya

Calculated Risk Hamp Debt To Income Ratios Of Permanent Mods

Debt To Income Dti Ratio Calculator Money

7 Money Ratios Every Clever Girl Should Know Clever Girl Finance

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

What S Considered A Good Debt To Income Dti Ratio

Debt To Income Dti Ratio Calculator Money

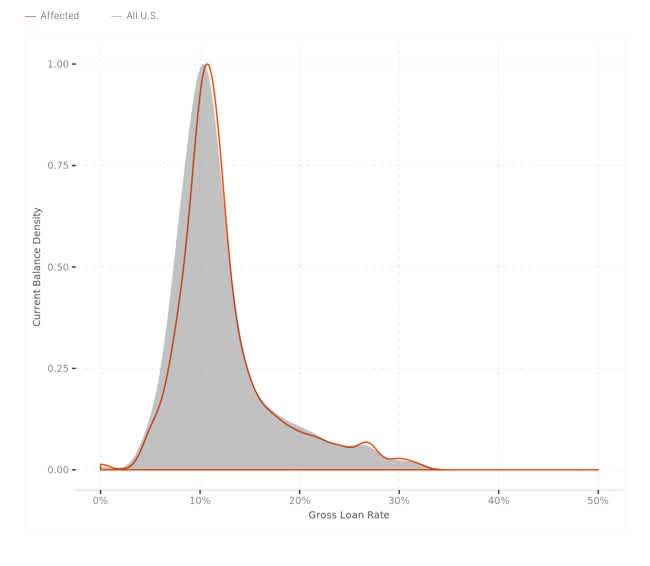

Resources Insight Report Investor Exposure To Marketplace Loans Affected By Hurricane Florence

Mortgage Lender Woes Wolf Street

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Investing In Real Estate Module 7 Of Family Financial Freedom

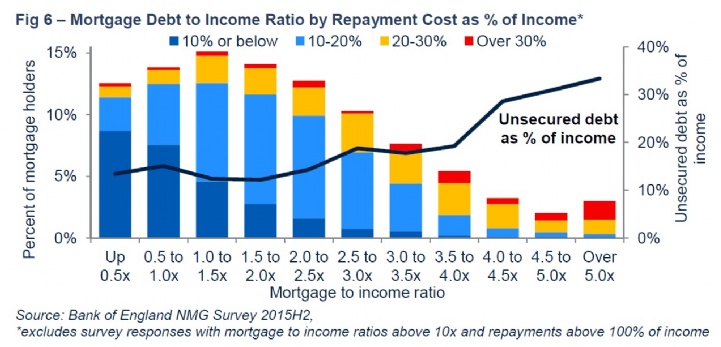

Savills Usa Household Debt

What Is An Acceptable Debt To Income Ratio Hoyes Michalos

Debt To Income Ratio How To Calculate Your Dti Nerdwallet

5 Steps To Do When You Get Denied For A Mortgage